Best Customer Experience

SoFi Review: Our take – SoFi is a legitimate online bank with a top-tier savings and checking account in one. With a generous welcome bonus and a six-month savings boost, as well as a great experience for customers, we think SoFi is absolutely worth considering.

Online Banking

| Savings account APY | 3.30% |

| Checking account APY | 0.50% |

| Welcome bonus | Up to $300 |

| Temporary savings boost | 0.70% APY on savings |

| Minimum deposit | $0 |

| Monthly fees | None |

| FDIC insurance | $250,000, plus up to $3 million additional |

| ATM network | 55,000+ fee-free ATMs |

| Overdraft fee | None |

| Overdraft coverage | Covered up to $50, fee-free, with $1,000 direct deposit |

Our take: Is SoFi a trustworthy bank?

SoFi is absolutely a trustworthy bank. SoFi’s bank accounts carry $250,000 of FDIC insurance ($500,000 for joint accounts), but you can get an additional $3 million in insurance by participating in the SoFi Insured Deposit program.

SoFi’s bank account also comes with multiple security features, including:

- 24/7 account monitoring and fraud detection

- Two-factor authentication (biometric logins)

- Real-time transaction alerts for the debit card

What are the benefits of having a SoFi account?

SoFi is more than just a trustworthy bank; it’s a really good bank. In fact, SoFi has one of the best high-yield savings accounts and one of the best checking accounts available; it earns an excellent LendEDU rating for its superior customer service and attractive savings rate.

Here are a few reasons to make SoFi your primary bank account:

High APY

First and foremost: This bank account, which is an all-in-one checking and savings account, pays a super high interest rate on your savings and checking deposits:

- Savings: 3.30% APY

- Checking: 0.50% APY

The checking APY is especially noteworthy. Most banks don’t offer any interest on checking deposits; those that do typically offer a nominal amount.

For instance, BMO’s Relationship Checking is advertised as paying interest, but the yield is only 0.01% APY, no matter the balance. Capital One’s 360 Checking is more attractive; it pays out 0.10% APY on checking balances.

To get the high APYs, you need to set up monthly direct deposit (any amount) or deposit at least $5,000 once a month.

Temporary savings boost

New customers can get a temporary (six-month) 0.70% APY boost on their savings deposit (a total of 4.00% APY). This boost applies as long as you keep your eligible direct deposit each month.

ATMs

You can access 55,000+ ATMs around the country, free of charge. This makes managing money in your online-only account much easier.

Vaults

You can have up to 20 Vaults, which operate like separate savings buckets within your SoFi High Yield Savings Account. These let you organize your savings into various goals: emergency savings, a down payment for a house, a vacation fund, you name it.

Automatic savings features

You can put those savings goals on autopilot with two automatic savings features for Vaults: recurring transfers and Roundups.

- Recurring transfers: First, set up automatic recurring transfers from your main account into the Vaults so you contribute money every week, month, or paycheck (whatever works for you).

- Roundups: You can also turn on Roundups; whenever you swipe your debit card, SoFi will round the purchase up to the next dollar, and the spare change gets moved to your preferred Vault.

Early paycheck access

When you get your paycheck direct-deposited into SoFi, you may be able to access it up to two days earlier than you would with a traditional bank.

Welcome bonus

Right now, when you open a SoFi bank account, you could earn a welcome bonus of either $50 or $300, depending on the amount you receive via direct deposit within the first 25 days of account opening. The combined size of your direct deposits affects the size of the bonus:

| Direct deposit amount (total) | Bonus size |

|---|---|

| $1,000 – $4,999.99 | $50 |

| $5,000 or more | $300 |

No monthly or overdraft fees

SoFi doesn’t charge any monthly service fees for its bank account, and there are also no fees if you overdraft.

In addition to fee-free overdraft, you can rely on no-fee overdraft coverage to ensure transactions still go through when your checking account is short on funds: Get covered for up to $50 with a direct deposit of at least $300.

Review of SoFi banking products

Although the SoFi bank account is a combo account, called the SoFi Checking and Savings Account, let’s take a look at each account type, plus the International Money Transfers features, separately.

SoFi Bank High Yield Savings Account review

Best Customer Experience

About SoFi HYSAs

- High APY

- Temporary savings boost

- Extensive FDIC insurance

- Automatic savings features

- Up to 20 Vaults for organization

- No physical branches

- Direct deposit requirements for high APY (and temporary boost)

| APY | 3.30% |

| Temporary savings boost | 0.70% APY on savings for up to 6 months |

| Monthly fees | None |

| Minimum deposit | $0 |

SoFi Checking Account

About SoFi Checking Accounts

- High APY

- No monthly fees

- No overdraft fees

- Fee-free overdraft protection

- Early paycheck access

- Wide, fee-free ATM network

- No physical branches

- Up to $4.95 cash deposit fees at Green Dot locations

- Overdraft coverage limited to $50

| APY | 0.50% |

| Monthly fees | None |

| Overdraft fees | None |

| Minimum deposit | $0 |

| ATM network | 55,000+ fee-free |

SoFi International Money Transfers

SoFi also offers easy international money transfers, but only if you have a SoFi Checking and Savings Account. You can send money to more than 30 countries with one low flat fee, regardless of the destination.

The cost includes a processing fee and network fee, which can vary depending on how much you’re sending. The fees are clear in the SoFi mobile app before you send and are much lower than traditional wire transfer fees.

This feature could make SoFi a better option than any of these best international money transfer services.

SoFi mobile banking review

One of the big downsides to the SoFi High Yield Savings Account and the SoFi Checking Account is that it’s completely online; SoFi does not have any physical branches like you’d get with a more traditional savings account. While you can access your account via ATM and Green Dot locations, you’ll do most of your banking online, at a computer or via the mobile app.

Now, SoFi has a super easy-to-use mobile app, which allows you to manage all your SoFi accounts in one place, from the savings and checking combo account to student loans to mortgage payments. Customers rate the app quite well on the Apple App Store, and it has a decent (though not perfect) rating on Google Play.

Is SoFi Bank considered a real bank?

Yes, SoFi is a real bank. SoFi (Social Finance Inc.) launched in August 2011, originally focused on student loans but expanding over time to offer a wide range of financial services, including a bank account. SoFi is an FDIC member and issues its own debit card via Mastercard.

This is a notable contrast to many financial technology (fintech) companies that offer banking services, but aren’t banks themselves. This includes popular online “banks” such as Chime and Current.

What else does SoFi offer?

This SoFi bank account is focused on (of course) SoFi’s combination checking and savings account. But the financial company actually got its start as a lender and offers a wide range of products and services, including:

- Student loans: SoFi offers a wide range of private student loans for undergrads, grad students, professional students, and parents. We named SoFi as one of the best private student loan lenders; it earned our top spot for graduate loans.

- Student loan refinancing: SoFi is also our overall pick for the best student loan refinancing because of its competitive rates and flexible repayment terms.

- Mortgages: SoFi also offers a wide range of mortgage options for homebuyers; we selected it as one of the best mortgage lenders this year because of its close-on-time guarantee.

- Home equity: You can also tap into your home equity via a SoFi home equity loan or home equity line of credit.

- Personal loans: SoFi offers personal loans from $5,000 to $100,000. SoFi personal loans are great if you need a large personal loan, but not ideal if you want a small loan. We named SoFi the best personal loan lender for good credit.

- Investing and crypto: You can use SoFi for self-directed investing, get help with a robo-advisor, set up an IRA, or even invest in crypto.

- Credit cards: SoFi offers a few reward credit card options. They’re decent enough, but not close to being the best in the industry.

- Insurance: SoFi offers home insurance, auto insurance, life insurance, and renters insurance.

- Auto refinancing: While you can’t get a car loan with SoFi, you can refinance an auto loan with the lender.

- Other products: If you have multiple accounts with SoFi, it may be worth upgrading to a SoFi Plus membership. You can also use SoFi for a number of financial insights, like budgeting and credit score monitoring. Finally, SoFi has credit and banking solutions for business owners.

SoFi customer reviews and ratings

One of the best ways to determine whether a SoFi bank account is right for you is to seek out SoFi bank account reviews from actual customers, whether they’re your own friends, family, coworkers, and neighbors, or real customers on review sites.

For starters, check out SoFi’s rating on sites like Trustpilot and Better Business Bureau, but also read through some of the recent reviews to understand what the majority of complaints are about: bad tech, customer service, etc.

Here are SoFi’s current customer review ratings:

| Platform | Rating | Number of reviews |

|---|---|---|

| Trustpilot | 4.1/5 | 9,151 |

| BBB | 1.3/5 | 377 |

In addition to review sites, see what customers are saying on Reddit. Reddit is a great way to get a grasp on how real SoFi customers feel about their bank accounts. (Make sure you limit your search to SoFi’s bank accounts, unless you’re considering other products, such as credit cards and student loans, as well.)

Here are two Reddit threads where customers discuss whether it’s worth opening a bank account with SoFi, as well as the pros and cons:

How to open a checking and savings account with SoFi

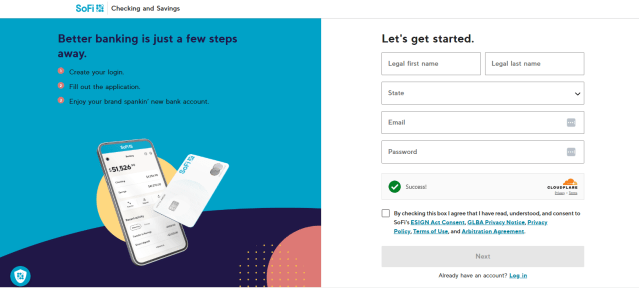

Opening a bank account with SoFi is easy. You can do it online in a matter of minutes, and you don’t even need an opening deposit to do so.

Just visit the SoFi banking website, enter your email, and click “Open an account” to launch the signup process.

The actual process is fast and easy. Create your login info, fill out an application, and get the bank account.

You can then work on funding it by setting up direct deposit and/or connecting an external bank account and transferring funds over.

SoFi alternatives

SoFi clearly has one of the best bank accounts currently available, but we recommend several great options if SoFi doesn’t feel like the right fit for you.

Here’s how SoFi stacks up against three alternatives that rank among our best high-yield savings accounts. (Note: Both Synchrony and Barclays lack checking accounts.)

SoFi vs. Capital One

Capital One is our overall choice for a high-yield savings account. The 360 Performance Savings account matches SoFi’s standard savings rate, but the mobile app is more user-friendly, and you can get in-person help at a Capital One Café or bank branch.

Capital One’s checking account earns 0.10% APY (which is phenomenal, except when compared to SoFi). Notably, Capital One was among the first major checking accounts to eliminate overdraft fees, and the ATM network is more extensive (70,000+ fee-free).

Plus, Capital One’s credit card lineup is more extensive (and better all-around) than SoFi’s. If you want your bank account and credit cards all under one bank, go with Capital One.

Here’s what to keep in mind when comparing savings accounts.

SoFi vs. Synchrony

Synchrony’s High Yield Savings account currently earns a higher APY than SoFi. Like SoFi, Synchrony has no monthly fees and no minimum opening deposit requirements. Its biggest flaw is the lack of a checking account; you’ll need to connect an external account to easily deposit and withdraw funds.

SoFi vs. Barclays

Barclays has two attractive savings accounts. The Tiered Savings can earn up to 4.00% APY, but only if you maintain a super-high balance ($250,000 to $1 million). The Online Savings account still beats SoFi at 3.60% APY. However, the glaring omission with Barclays is the same as with Synchrony: no checking account.

How to contact SoFi

You can contact SoFi via email, over the phone, or using online chat. Navigate to SoFi’s contact page to direct your communication based on your account type or need.

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

Related articles

About our contributors

-

Written by Timothy Moore, CFEI®

Written by Timothy Moore, CFEI®Timothy Moore is a Certified Financial Education Instructor (CFEI®) specializing in bank accounts, student loans, taxes, and insurance. His passion is helping readers navigate life on a tight budget.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.