Personal Loans

Learn more about how personal loans work & what you can use them for, see our picks for the best personal loan lenders, and read reviews of the top lenders in the industry.

Featured post

See our editorial team’s picks for the best personal loans.

How personal loans work

Personal loans don’t often seem complicated, but you should understand several specific terms before you apply for one.

Personal loan uses

You can use personal loans for almost anything, including paying off debt and home improvements.

Personal loans by credit range

Your credit score is critical in determining eligibility for a personal loan. Before applying, check your credit score to determine whether your credit is excellent, good, fair, or poor. Compare companies that lend to borrowers in your credit range to boost your chances of approval.

Personal loan reviews

If you’re considering applying for a personal loan through a specific company, you should understand how that company operates and the repayment terms.

- SoFi Personal Loans Review

- LightStream Personal Loans Review

- Upgrade Personal Loans Review

- Upstart Personal Loans Review

- List of Personal Loan Companies

All personal loan articles

-

What Can Be Used As Collateral for a Personal Loan?

Many people think of personal loans as unsecured loans—loans you can get based on your credit profile alone. But there are secured personal loans available that offer more competitive interest…

-

Truist Personal Loans Review 2026: Loans Through LightStream

With no fees and a generous rate beat program, LightStream personal loans from Truist are a solid option for quick funding. But you can’t prequalify with a soft credit check,…

-

Top 10 Banks for Personal Loans in 2026

Personal loans can be handy for everything from consolidating debt to covering moving expenses. With online lenders grabbing headlines, many people overlook traditional banks. But a bank can be an…

-

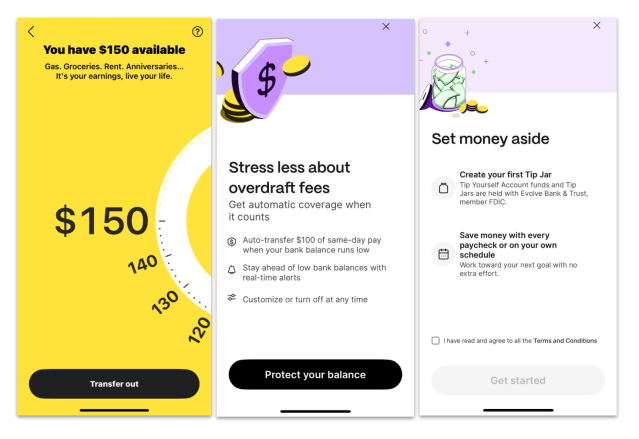

Is Brigit Legit? Cash Advance and App Review [2026]

What is Brigit? Brigit is a financial app that launched in 2019 with a clear goal: to help everyday people stay on top of their money and avoid those frustrating…

-

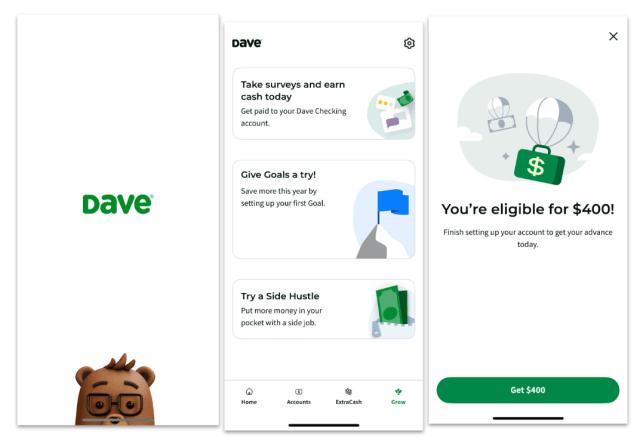

Dave ExtraCash Cash Advance: 2026 Review

Funding Up to $500 Speed of advance 2 – 3 days; Instant (with fee) Subscription fees $1/month Instant funding fees $1.99 – $13.9 Dave is a digital banking app that…

-

MoneyLion Cash Advance Review

Founded in 2013, MoneyLion began with a mission to help Americans who may not have access to traditional banking opportunities. It uses technology to provide low-cost (or even free) financial…

-

Is EarnIn App Legit? Our 2026 Review

Founded in 2014, the EarnIn app was created to help responsibly-employed borrowers with cash flow issues between paychecks. EarnIn stands out against competitors because it doesn’t charge mandatory fees or…

-

Klover App 2026 Review: Small Advances, Big Privacy Trade-Offs

Klover offers fee-free cash advances up to $200 with no interest or credit check—but there’s a catch. To qualify, you’ll need to share your financial data and complete tasks in…

-

Fig Loans Review 2026: Small Installment Loans and Credit Builder Options for Bad Credit

Founded in 2015, Fig Loans is a mission-driven lender designed to support working-class Americans who may not qualify for traditional credit. It began in Houston, Texas, as a partnership with…

-

No-Interest Personal Loans

Borrowing money comes at a cost. Depending on the lender, you might need to pay application fees, origination fees, and late payment fees. You also must pay interest on the…