Personal Finance

See our best personal finance blog content all in one place. Learn about making & saving money, managing debt, and more.

1. Manage Your Money

Money shapes your lifestyle, opportunities, and security. Learn the fundamentals of financial literacy.

Understand the latest trends in savings, debt, and investing with our in-depth financial reports.

We break down the most trusted financial institutions for banking, investing, and credit-building in our roundup of the best personal finance companies in 2025.

2. Manage Your Debt

Debt isn’t always bad, but without a plan, it can spiral out of control. You can take charge of your finances with proven strategies.

Even if you’re broke or just barely making ends meet, this step-by-step guide will help you regain financial stability.

Looking to simplify multiple debts? These are the top-rated options for consolidating loans.

Overwhelmed with debt and not sure where to start? A professional debt relief service may be the way to go.

If you’re not sure if debt relief is the right path forward for you, read more about how it works.

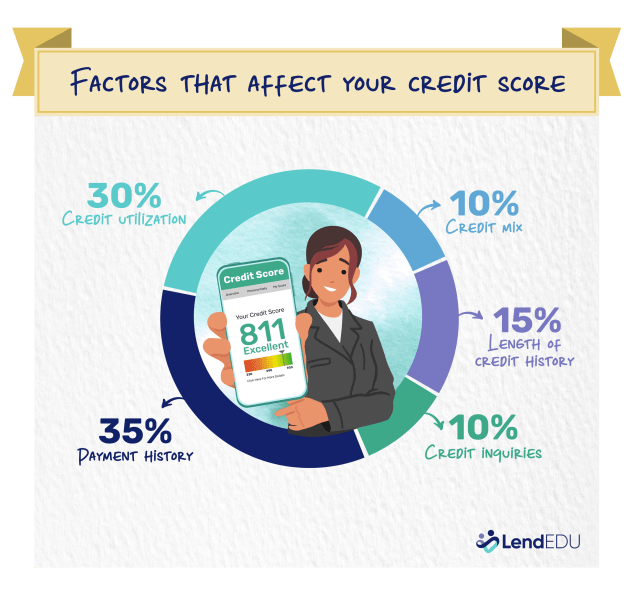

3. Improve Your Credit Score

A strong credit score opens doors to better financial opportunities. Learn how to boost yours.

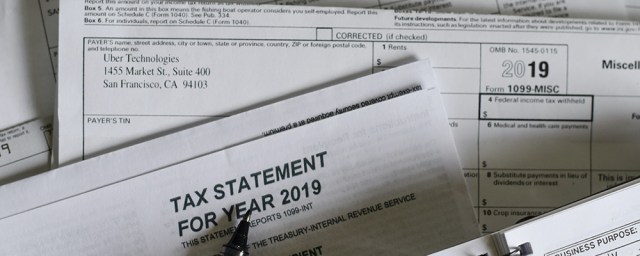

4. Stay on Top of Your Taxes

Taxes can be complicated, but with the right strategy, you can reduce your liability and avoid issues with the IRS.

If you owe back taxes, we’ll walk you through the five options that can help you resolve your debt without expensive legal fees.

Here’s how to check if you have outstanding tax debt and what steps to take.

If you need professional help with tax debt, these companies offer tried-and-true solutions.

5. Invest and Grow Your Wealth

Investing helps grow your wealth over time. Whether you’re interested in stocks, gold, or real estate, find the right options for your financial goals.

Explore expert analysis on the stability of the U.S. dollar and what it means for investors.

Smart investors spread their risk. Here are the best ways to diversify and protect your investments.

Gold has been a reliable store of value for centuries. Learn how to add it to your portfolio.

All personal finance articles

-

Is Now a Good Time to Buy Gold? What We Know in February 2026

Gold prices hit an all-time high of $4,800 per ounce on October 3, 2025. So where will it go from here? Is now a good time to buy? We’ll break…

-

How to Invest in a Silver IRA

A silver IRA allows you to diversify your retirement portfolio by investing in physical silver. Silver is often more accessible than gold, making it an attractive option for many investors.…

-

Priority Gold: 2026 Review

Founded in 2001 and based in Dallas, Priority Gold is a trusted precious metals dealer in the United States. It promises competitive pricing, excellent customer service, and a streamlined purchasing…

-

Capital One Shopping Review

About Capital One Shopping Capital One Shopping is a free browser extension that does the bargain-hunting for you across over 30,000 online retailers, including hotel booking sites. Once installed, this…

-

Gold Alliance Review

Gold Alliance, established to simplify precious metal investments, caters to diverse investors. Its mission focuses on accessible investment in gold, silver, palladium, and platinum. Gold Alliance offers precious metals IRAs…

-

Precision Tax Relief Review 2026: Transparent Pricing and Top-Rated Service

Precision Tax Relief is one of the most trusted names in tax resolution, and it shows. With a 94% success rate in Offer in Compromise cases, flat-fee pricing, and stellar…

-

4 Main Tax Debt Forgiveness Programs You Need to Know if You Owe

Tax debt is what you owe the IRS if you don’t pay in full when you file your return. The IRS and state government both expect you to make a…

-

What Is a Custodian for a Gold IRA?

Investing in gold is a popular way to diversify assets and protect against inflation. A gold IRA has unique tax benefits that allow you to hold physical gold in a…

-

How to Respond to a Notice of Deficiency

If the IRS completes an examination of what you owe and proposes changes, the agency sends a notice of deficiency. It’s also called a CP3219N Notice, 90-day letter, or Letter…

-

What Are IRS Audit Penalties?

Your odds of being selected for an IRS audit are generally low, but never zero. If your return is flagged for closer review, you may be subject to IRS audit…