Personal Finance

See our best personal finance blog content all in one place. Learn about making & saving money, managing debt, and more.

1. Manage Your Money

Money shapes your lifestyle, opportunities, and security. Learn the fundamentals of financial literacy.

Understand the latest trends in savings, debt, and investing with our in-depth financial reports.

We break down the most trusted financial institutions for banking, investing, and credit-building in our roundup of the best personal finance companies in 2025.

2. Manage Your Debt

Debt isn’t always bad, but without a plan, it can spiral out of control. You can take charge of your finances with proven strategies.

Even if you’re broke or just barely making ends meet, this step-by-step guide will help you regain financial stability.

Looking to simplify multiple debts? These are the top-rated options for consolidating loans.

Overwhelmed with debt and not sure where to start? A professional debt relief service may be the way to go.

If you’re not sure if debt relief is the right path forward for you, read more about how it works.

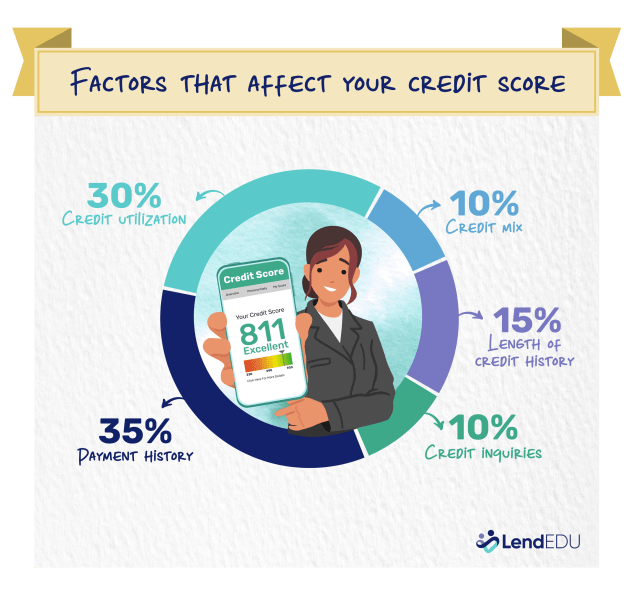

3. Improve Your Credit Score

A strong credit score opens doors to better financial opportunities. Learn how to boost yours.

4. Stay on Top of Your Taxes

Taxes can be complicated, but with the right strategy, you can reduce your liability and avoid issues with the IRS.

If you owe back taxes, we’ll walk you through the five options that can help you resolve your debt without expensive legal fees.

Here’s how to check if you have outstanding tax debt and what steps to take.

If you need professional help with tax debt, these companies offer tried-and-true solutions.

5. Invest and Grow Your Wealth

Investing helps grow your wealth over time. Whether you’re interested in stocks, gold, or real estate, find the right options for your financial goals.

Explore expert analysis on the stability of the U.S. dollar and what it means for investors.

Smart investors spread their risk. Here are the best ways to diversify and protect your investments.

Gold has been a reliable store of value for centuries. Learn how to add it to your portfolio.

All personal finance articles

-

What to Know About Free Government Debt Relief Programs

If you’re struggling with debt, you might wonder whether free government debt relief programs can help you. That is indeed the case for certain types of debt, though depending on…

-

Accredited Debt Relief Review: Best Customer Experience for Managing High Debt

About Accredited Debt Relief and Beyond Finance Founded in 2011, Accredited Debt Relief is based in San Diego, California, and is a subsidiary of Beyond Finance, a Chicago-based fintech company…

-

Can I Cancel My 401(k) and Cash Out While Still Employed?

If you’ve been contributing to a workplace 401(k) for years, chances are you intend to use that money for retirement. But if the unexpected happens, and you need or want…

-

![How to Survive Unpaid Maternity Leave [8 Steps]](https://capital-gateway.live/wp-content/uploads/2024/11/How-to-Survive-Unpaid-Maternity-Leave.jpg?w=640)

How to Survive Unpaid Maternity Leave [8 Steps]

This comprehensive guide will teach you how to survive unpaid maternity leave by giving concrete steps to help you plan and prepare for this important time. It’s possible to successfully…

-

Debt Relief vs. Debt Consolidation: Which Is Better for Your Debt?

If you’re deciding between debt relief and debt consolidation, the right choice depends less on the labels and more on whether you can realistically afford your debt. Debt consolidation works…

-

BC Tax Company Review 2026: Transparent Tax Relief With a No-Fee Consultation

BC Tax holds its own among top tax relief companies. What makes it stand out? You get a free, no-commitment consultation and don’t have to pay any fees during the…

-

Why Do People Buy Gold? 10 Solid Reasons to Invest

Gold has long been viewed as a stable investment. Many people invest in gold to protect their wealth and hedge their bets during hard economic times. Gold has outstanding benefits…

-

![6 Reasons Gold Prices Drop and What It Means for Investors [November 2024]](https://capital-gateway.live/wp-content/uploads/2024/11/6-Reasons-Gold-Prices-Drop-and-What-It-Means-for-Investors-November-2024.jpg?w=640)

6 Reasons Gold Prices Drop and What They Mean for Investors in February 2026

If there’s one truth about investments, it’s this: nothing is certain. Whether you’re investing in stocks, real estate, or precious metals such as gold, prices fluctuate and no one can…

-

What If You Can’t Pay Your Taxes? 12 Strategies to Explore

If you can’t pay your taxes, you’re not alone—and you’re not out of options. Whether you’re dealing with a temporary cash shortfall or a more serious financial hardship, there are…

-

What Is a Tax Refund Advance, and What’s the Soonest You Can Get One?

If you’re eligible for a tax refund, you may be able to get a portion of what you’re owed early in the form of an advance. A tax refund advance…