Personal Finance

See our best personal finance blog content all in one place. Learn about making & saving money, managing debt, and more.

1. Manage Your Money

Money shapes your lifestyle, opportunities, and security. Learn the fundamentals of financial literacy.

Understand the latest trends in savings, debt, and investing with our in-depth financial reports.

We break down the most trusted financial institutions for banking, investing, and credit-building in our roundup of the best personal finance companies in 2025.

2. Manage Your Debt

Debt isn’t always bad, but without a plan, it can spiral out of control. You can take charge of your finances with proven strategies.

Even if you’re broke or just barely making ends meet, this step-by-step guide will help you regain financial stability.

Looking to simplify multiple debts? These are the top-rated options for consolidating loans.

Overwhelmed with debt and not sure where to start? A professional debt relief service may be the way to go.

If you’re not sure if debt relief is the right path forward for you, read more about how it works.

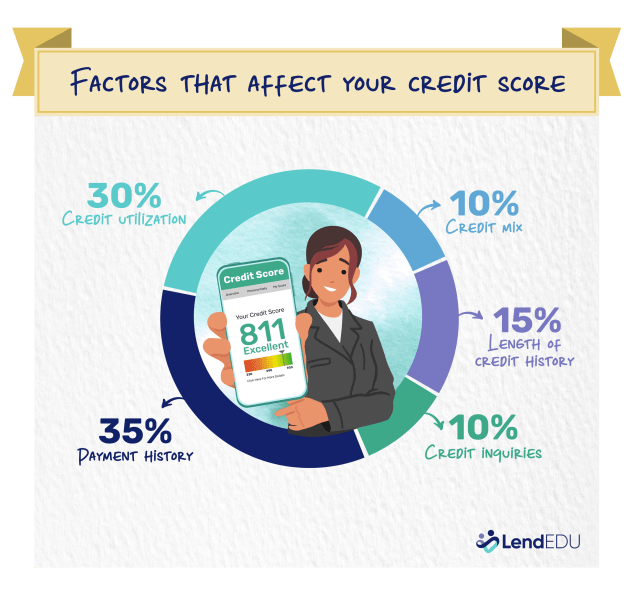

3. Improve Your Credit Score

A strong credit score opens doors to better financial opportunities. Learn how to boost yours.

4. Stay on Top of Your Taxes

Taxes can be complicated, but with the right strategy, you can reduce your liability and avoid issues with the IRS.

If you owe back taxes, we’ll walk you through the five options that can help you resolve your debt without expensive legal fees.

Here’s how to check if you have outstanding tax debt and what steps to take.

If you need professional help with tax debt, these companies offer tried-and-true solutions.

5. Invest and Grow Your Wealth

Investing helps grow your wealth over time. Whether you’re interested in stocks, gold, or real estate, find the right options for your financial goals.

Explore expert analysis on the stability of the U.S. dollar and what it means for investors.

Smart investors spread their risk. Here are the best ways to diversify and protect your investments.

Gold has been a reliable store of value for centuries. Learn how to add it to your portfolio.

All personal finance articles

-

Wage Garnishment: What It Is and How to Stop It

When you can’t pay a creditor, wage garnishment to pay the debt can make tough times even tougher. Wage garnishment is when a creditor or the government legally requires your…

-

6 Best Books for Getting Out of Debt in 2026

Libraries and bookstores are packed with finance books from wealthy authors who think they know best. Some offer solid advice, but the best books for getting out of debt go…

-

TaxRise 2026 Review: Is It Legit?

TaxRise is a tax relief company that helps resolve IRS issues by handling calls, negotiations, and paperwork on your behalf. It’s a solid choice if you have a smaller tax…

-

Who Does the IRS Audit Most? Millionaires and EITC Recipients

The IRS audits some taxpayers to ensure they pay what is deemed necessary. In the fiscal year 2023, the federal agency closed 582,944 audits, which resulted in $31.9 billion in…

-

Gold-Silver Ratio: Its History, 2026 Predictions, and How to Use It for Your Investments

The gold-silver ratio (GSR) is a valuable tool for investors seeking to time their entry into precious metals. As of June 2025, the GSR is approximately 92, reflecting silver’s recent…

-

When Does Tax Season Start and End? 2026 Dates and Deadlines to Know

January 27, 2025, marked the start of the 2025 tax filing season. This is the earliest date tax filers could begin submitting their 2024 returns. But when does tax season…

-

10 Best Books for Building Wealth in 2026

Finding the best wealth-building books can feel overwhelming—so many lists, so many recommendations, but not all of them are actually useful today. That’s why I’ve put together a list of…

-

Expert Gold Price Predictions for 2026 and Beyond: CFPs Weigh In

Gold has long been valued as a hedge against inflation and a safe haven during tumultuous times. So it may be no surprise that gold prices hit record highs in…

-

Cómo salir de deudas en 8 pasos (incluso si no tiene dinero o sus ingresos son bajos)

Si está endeudado, no está solo. Según los últimos datos de la Reserva Federal, la deuda acumulada de los hogares estadounidenses ha aumentado desde el último trimestre y ahora asciende…

-

Rosland Capital 2026 Review: Why It’s Not the Best Option for Gold Beginners

Rosland Capital is a long-standing precious metals dealer offering gold, silver, and platinum coins and bars, with a focus on IRA-eligible products. While it has a solid buyback program and…