1. Manage Your Money

Money shapes your lifestyle, opportunities, and security. Learn the fundamentals of financial literacy.

Understand the latest trends in savings, debt, and investing with our in-depth financial reports.

We break down the most trusted financial institutions for banking, investing, and credit-building in our roundup of the best personal finance companies in 2025.

2. Manage Your Debt

Debt isn’t always bad, but without a plan, it can spiral out of control. You can take charge of your finances with proven strategies.

Even if you’re broke or just barely making ends meet, this step-by-step guide will help you regain financial stability.

Looking to simplify multiple debts? These are the top-rated options for consolidating loans.

Overwhelmed with debt and not sure where to start? A professional debt relief service may be the way to go.

If you’re not sure if debt relief is the right path forward for you, read more about how it works.

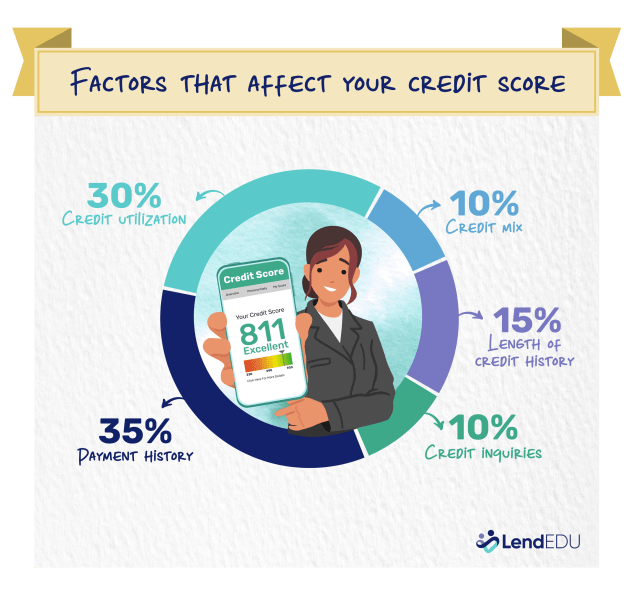

3. Improve Your Credit Score

A strong credit score opens doors to better financial opportunities. Learn how to boost yours.

4. Stay on Top of Your Taxes

Taxes can be complicated, but with the right strategy, you can reduce your liability and avoid issues with the IRS.

If you owe back taxes, we’ll walk you through the five options that can help you resolve your debt without expensive legal fees.

Here’s how to check if you have outstanding tax debt and what steps to take.

If you need professional help with tax debt, these companies offer tried-and-true solutions.

5. Invest and Grow Your Wealth

Investing helps grow your wealth over time. Whether you’re interested in stocks, gold, or real estate, find the right options for your financial goals.

Explore expert analysis on the stability of the U.S. dollar and what it means for investors.

Smart investors spread their risk. Here are the best ways to diversify and protect your investments.

Gold has been a reliable store of value for centuries. Learn how to add it to your portfolio.

Latest on personal finance:

How Much Money Do I Need to Invest in Gold? [Minimum Amounts and Solutions for Small Investors]

You don’t need a fortune to start investing in gold. Are you working with a...

How to Avoid Bankruptcy: 9 Alternatives to Consider Before Filing

If you’re struggling financially, filing for bankruptcy may feel like the only option. However, it’s...

The 9 Best Ways to Diversify Your Investment Portfolio

Diversifying your investment portfolio is a strategy for protecting and growing your investments. You reduce...

How to Get Rid of Medical Bills If You Can’t Pay: Debt Relief and Other Options

Like more than 100 million Americans, you may be struggling with medical debt that can...

Thor Metals Group 2025 Review: All-Risk Insurance and Glowing Customer Reviews

Thor Metals Group is a precious metals investing company based in Boca Raton, Florida. The...

Debt Relief vs. Bankruptcy: Pros, Cons, and How to Choose the Right Path

When you’re overwhelmed by medical bills, credit cards, or personal loans, bankruptcy may seem like...

Your Guide to Emergency Debt Relief Options

Finding help when you need emergency debt relief can be incredibly stressful, especially if you’re worried about making your mortgage payment or paying...

[Q&A] How Can I Eliminate My Payday Loans? The Best Debt Relief and Debt Consolidation Options

Payday loans might feel like your only option when your back’s against the wall, but...

What Is Debt Relief, and How Does It Work?

Sometimes it seems like you’ll be stuck in debt forever, no matter how hard you try. But it is possible to get out...

Best Debt Relief Companies of 2025 and How They Operate

If you’re struggling with massive debt from credit cards, personal loans, student loans, back taxes,...